Part Two of a two-part series on business valuation fundamentals – worth and multiple.

In part one of this series, I discussed common mistakes business owners make when quantifying what they think their business is worth. In this final part of the series, I address additional factors used considered in valuations.

Many business owners overlook the role of the balance sheet in determining value. The extent to which a business has too little or too much working capital (relative to the normal level needed to operate the business), an adjustment may be needed to decrease or increase value accordingly. It is also important to understand the impact that debt has on the valuation – this is discussed further in the following section.

Enterprise Value vs. Share (Equity) Value

Commonly misunderstood by business owners, enterprise value, or EV, refers to the total value of the company’s shares (equity) and debt. The most common mistakes made by business owners when using a multiple of earnings before interest, taxes, depreciation and amortization (EBITDA) to determine the value of their businesses are: When applying a multiple to the company’s EBITDA, the owner does not use a maintainable level of EBITDA to determine the company’s enterprise value; and After applying the multiple to the company’s maintainable EBITDA, the owner does not subtract the company’s debt to derive the share value.

For example, Mr. A was seeking to sell the shares of his business for $4 million. When asked to explain how he derived the value, he indicated the business was generating $800,000 of EBITDA and he believed he could sell his business for five times EBITDA (or a ‘five-times multiple’). What he forgot was that he was not paying himself a salary to run the business and instead was compensated by having his company declare annual dividends. Further, he did not subtract the company’s debt to derive the share value.

Assuming a five-times multiple was correct for his business, the real value of his shares was actually half of what Mr. A calculated. The two adjustments needed to correct Mr. A’s calculation are: To deduct a fair market salary for somebody to run the business, let’s assume a reasonable salary of $200,000, to derive the adjusted maintainable EBITDA; and To deduct the company’s current debt amount. Here is the calculation:

Don’t Forget the Qualitative Factors

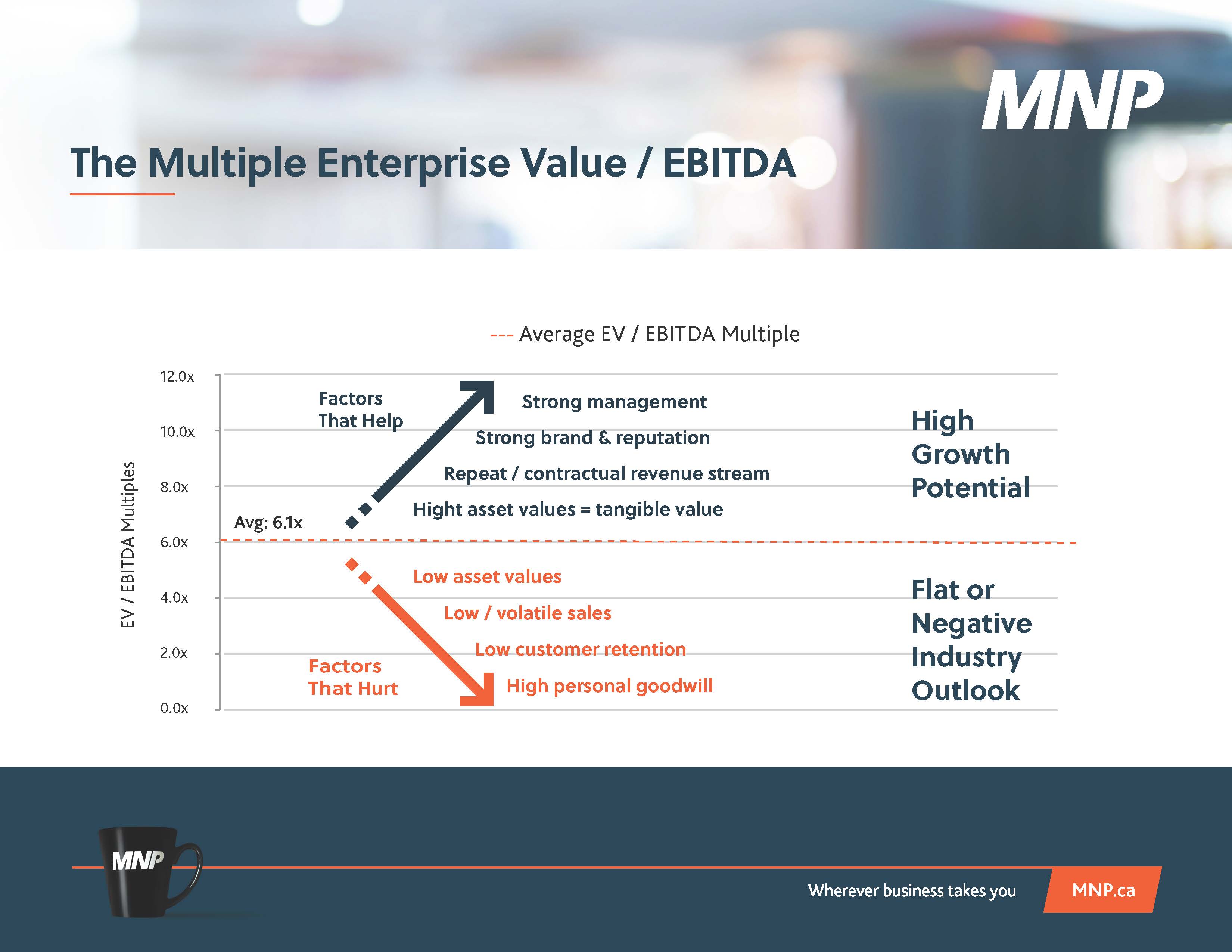

Enterprise value (EV) as a multiple of EBITDA is essentially a measure of risk and reward. A multiple can be higher or lower for a particular business due to the underlying risk associated with the selected cash flow of the business. Some key qualitative factors that are considered in a risk / reward analysis of a company are listed below.

Factors that tend to increase the multiple and increase value: A diversified customer base Long-standing, loyal customers, Long-term contracts signed with key customers, A strong management team - a company with a strong management team that is willing to stay on with the business post-transaction can be worth significantly more than a company without a follow-on management team. Financial buyers, and often, strategic buyers, will place a lot of value in a strong management team. Bigger companies typically transact for higher multiples largely due to reduced risk associated with generating the cash flows of bigger companies. All things being equal, bigger companies typically have a more diversified customer / revenue base, among other advantages.

Factors that tend to lower the multiple, and detract from value: Reliance on a key person(s)Reliance on one or a few key customers Volatility in earnings Low amount of tangible asset backing Existence of personal goodwill: personal goodwill exists when a key person (typically the owner-manager) has all (or the majority) of the key relationships with customers, suppliers and employees such that the business would not exist without that person. Often personal goodwill is related to the size of a company – this can detract from the value of a business and could result in a business being unsellable.

Transaction Multiples

The chart below illustrates why a multiple might be higher or lower than an industry’s average EV/EBITDA. For illustrative purposes, we’ve selected an average EV/EBITDA multiple of six times.

In conclusion

When business owners are considering successions plans, they need to understand the appropriate multiple to value a business, as each business and industry is unique. Whether buying or selling, an advisor knowledgeable and experienced with determining value and price, like a Chartered Business Valuator, will help navigate the complexities of valuation, including determining an appropriate multiple. Having a clear picture of all of the relevant factors brings peace of mind to a business owner that they are making an informed decision about their business.

With offices strategically located across Canada, MNP’s Corporate Finance and Valuations professionals deliver customized strategies to help you achieve your business goals.

Contact Craig Maloney, Managing Director, Corporate Finance, Valuations and Litigations Support, at 902.493.5430 or [email protected].