The business landscape is changing at a breakneck pace. Stakeholders are increasingly concerned about the consequences of their consumer, investment, and employment decisions. As people understand more about their place in an interconnected world, the demand for your organization to act in a more responsible, equitable and sustainable way is becoming ever louder. But how to do that in a meaningful way that still makes for profitable and innovative business decisions?

Table of Contents

- What is ESG?

- Why care about ESG?

- Advantages of a sustainable business model

- Why ESG reporting is critical

- How MNP can help

- Frequently Asked Questions

Top

What is ESG?

Environmental, social, and governance (ESG) are the three pillars stakeholders are increasingly using to measure the degree to which your organization is benefitting your community. They are also strategic imperatives to drive long-term, sustainable value in our changing world.

ESG business drivers

Environmental

- Energy efficiency

- Carbon footprint

- Water consumption

- Waste management

- Packaging

- Biodiversity management

Social

- Employee attraction and retention

- Diversity and inclusion

- Pay equity

- Customer data privacy

- Social acceptability of projects / business

- Organizational culture

Governance

- Climate change

- Cyber security

- Corruption and bribery

- Responsible taxes

- Compensation

- Reliable financial disclosure

Why care about ESG?

Organizations are facing increased demands from:

- Investors

- Regulators

- Community stakeholders

- Employees

- Boards of directors

A growing body of evidence is also revealing the long-term, intergenerational benefits of ESG — as well as the risks of not acting now.

TopAdvantages of a sustainable business model

A growing body of evidence suggests the long-term benefits of ESG initiatives far outweigh the initial costs. Since many of these advantages accumulate as the program matures, the real risk is in delaying getting started.

Increased competitiveness - Create distinct value propositions for clients, partners and consumers — and offer a clear reason to choose your business over a competitor.

Greater resilience - Absorb the costs of socio-environmental changes over your own timeline, rather than face them abruptly when these measures eventually become legal requirements.

Scalability - Realize measurable benefits as you continuously invest in ESG policy and practice maturity.

Resistance to commoditization - Deliver cultural, social, and economic value which extends beyond your product or service offerings.

Sustainability - Escape zero-sum business planning and shift toward more circular, longer-view economic thinking.

Better value for investors and stakeholders - Reduce investor risk and provide a more reliable return on investment.

Reshape value chains - Support network effects which enhance the impact and benefits of ESG efforts as they become more commonplace.

Create surplus - Reduce your dependence on finite resources and increase your ability to do more with less.

Clearer purpose and brand identity - Build strong relationships with employees, customers, investors, and stakeholders who resonate with your values and are loyal to your objectives.

TopWhy ESG reporting is critical

Consider that ESG is really two equally important activities: (1) the sustainability initiatives themselves, and (2) reporting on those activities.

Effective ESG reports are critical to communicate the urgency your organization places on sustainability, as well as quantification and validation of your sustainability efforts. Well formed ESG reports will:

- Compliment your financial reporting by providing a fuller picture of your value creation potential and enterprise risk landscape.

- Demonstrate your commitment to driving sustainability and competitive advantage along dimensions of cost leadership, product / service differentiation, and intellectual capital development.

- Measure and disclose intangible (yet financially material) factors such as strategy, innovation capacity, human capital management, reputation management, commercial risk mitigation, and resource efficiency.

- Disclose and discuss certain risks, uncertainties, challenges and trends that may affect financial performance.

How MNP can help

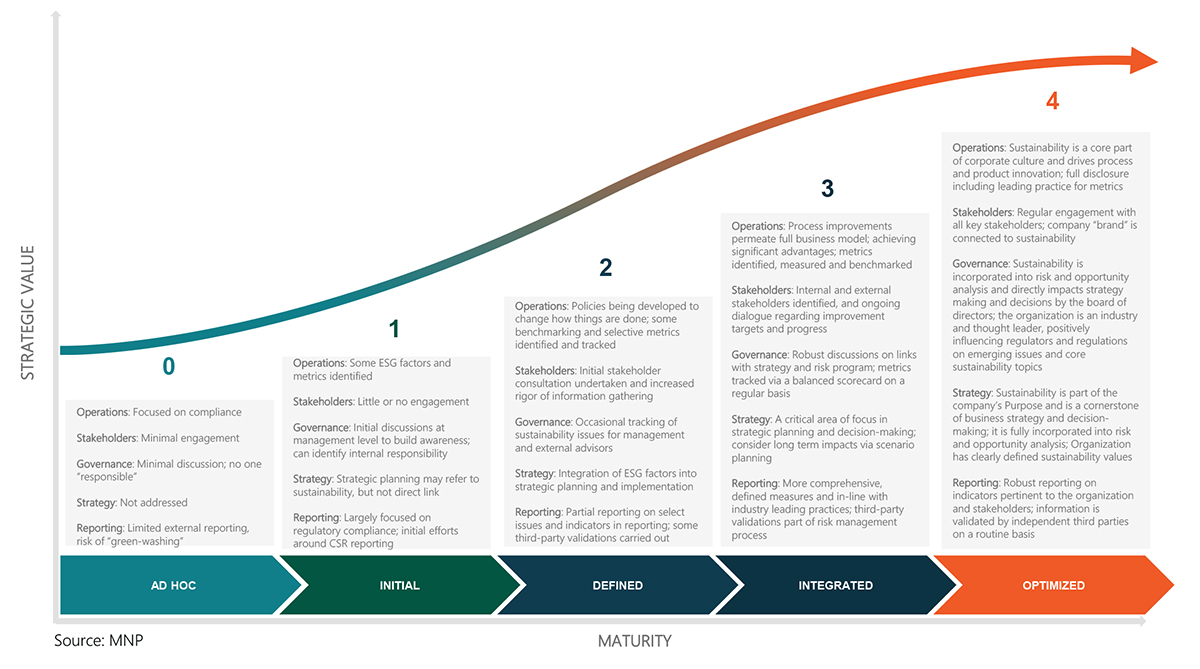

No matter where you are on your ESG journey, our team can assess your initiatives and help you move toward maturity.

Financial materiality and alignment

We can help you identify financially material ESG factors which may have a serious impact on your business and ensure they are aligned to your values, stakeholder concerns and societal norms.

Supporting your journey to sustainability

ESG is not a destination, but an iterative and ongoing process which your business must embrace over its entire lifecycle. To realize the advantages requires a commitment to continuously invest in, manage and monitor ESG efforts.

Sustainability Milestones

Building your business case

We can help you review any existing ESG reports, filings and initiatives, and assess your requirements. Together, we will identify opportunities and risks, and assess engagement requirements across board, management and other stakeholder groups. We will then compile our findings into a forward-looking document, including the potential costs and benefits of a formalized ESG strategy.

Defining and executing your ESG strategy

Once you decide to formalize your ESG program, we can help you define the value proposition, desired outcomes, and desired level of maturity. We’ll then drill down on specific ESG factors, targets, and key performance indicators to define a measurement, monitoring and reporting framework.

This includes building a resourcing strategy which defines:

- Key internal stakeholders and their responsibilities

- Ideal governance structure and board and executive involvement

- Desired tracking and reporting framework (i.e. internal, external, hybrid)

- Process for verifying progress and results (i.e. internally or via a third party)

- Technology requirements for program monitoring and data visualization

- Stakeholder engagement process and best practices

- We formalize these objectives into an overarching ESG strategy document, support you through the process of securing external stakeholder buy-in, and report on your progress throughout the implementation.

Maturing and optimizing your ESG program

If you already have an ESG program in place, we can work with your team to optimize the effectiveness of your ESG program, measure how well it is integrated with existing organizational, cultural, and enterprise risk management strategies, and evaluate the quality of your reporting.

Some common steps we will take through this process include:

- Implementing measurement and reporting frameworks for investors and stakeholders

- Evaluating board and management involvement in ESG strategy and initiatives

- Evaluating the degree to which ESG benchmarks are informing organizational actions

- Auditing and validating ESG factors and disclosures

Additional measures we can help you take in this phase include:

- Outlining processes and benchmarks to help your organization become ESG leaders in your industry / sector

- Recommending best practices for continuous engagement with ESG stakeholders (e.g. annual reporting, digital collaboration)

Contact

Mary Larson | Partner Consulting Services | 514.228.7905 | [email protected]

Kevin Joy | Partner Consulting Services | 514.228.7898 | [email protected]

Edward Olson | Regional Leader Enterprise Risk Services & ESG | 250.718.8687 | [email protected]