Covid-19 Impacts on Financial Markets, Valuation Multiples and Discount Rates

by Catherine Tremblay, CPA, CA, CBV, ASA, CFF

Almost overnight, our lives and businesses have been disrupted to an unprecedented degree by the COVID-19 global pandemic. With numerous businesses shut down and others scrambling to meet demand for essential services, we can only speculate on the timing of a return to pre-COVID norms. A big question emerging from this period of uncertainty is what is the impact on market valuation multiples and on the value of your business?

It is important to distinguish the market for privately held businesses from the stock market. Investors in private companies generally have a longer horizon than investors in small positions of public company stocks. This is especially true for speculators with very short holding periods. However, stock markets do provide a strong indication of market sentiment at any given point in time.

FINANCIAL MARKETS AND VOLATILITY

Financial markets experienced a steep decline in March 2020 when the coronavirus epidemic was declared a global pandemic, as shown in the graph below presenting the S&P/TSX Composite Index (the Index) over the last six months:

S&P/TSX COMPOSITE INDEX: NOVEMBER 12, 2019 TO MAY 11, 2020

By May 11, 2020 the Index had recovered by 34 percent from its low point in March. However, significant ambiguity remains around where the market will go as share price volatility continues to demonstrate uncertainty for business and economic prospects.

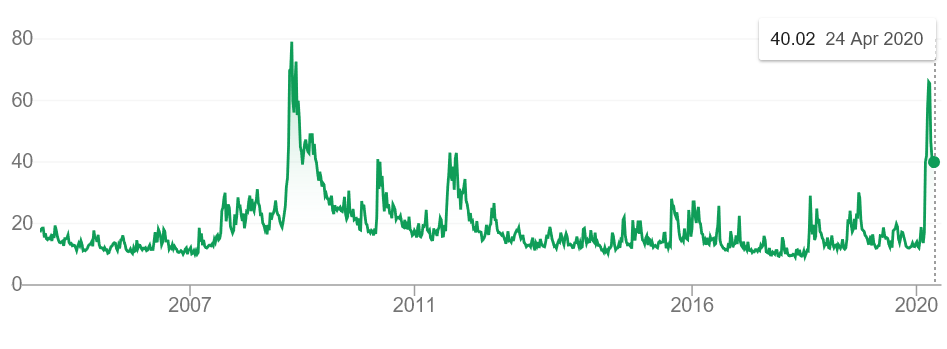

One of the leading market indicators for market risk and investor sentiment is the VIX Index from the Chicago Board Options Exchange. The VIX Index is a measure of the stock market’s expectation of volatility based on the prices of S&P 500 index options. The VIX Index spiked in March 2020 to levels not seen since the 2008 and 2009 financial crisis, as shown in the graph below:

VIX INDEX –APRIL 30, 2004 TO MAY 11, 2020

Businesses should address this uncertainty by preparing various cash flow scenarios considering the effects of COVID-19 and the expected timing of the lifting of government restrictions. Changes in a company’s market environment such as customer demand or supply chain disruptions should also be considered.

VALUATION MULTIPLES AND DISCOUNT RATES

Valuation multiples such as price to earnings or enterprise value to earnings before interest, taxes, depreciation and amortization (EBITDA) are calculated for public companies using stock market prices. The recent decrease in market value has caused public company valuation multiples to decline. For example, Air Canada’s enterprise value to LTM EBITDA multiple dropped from 6.3 times in December 2019 to 2.1 times at the end of March 2020. This is recognizing Air Canada operates in an industry highly affected by COVID-19; the impact will vary by industry.

To develop a private company valuation multiple, one can determine the rate of return an acquirer would demand on an investment in the business, equivalent to the discount rate used to calculate the present value of expected future cash flows. As the required rate of return is based on an investor’s perception of risk, COVID-19-related uncertainty will likely result in lower valuation multiples.

Current guidance is the risk premium on equities increased by 1.0 percent between December 2019 and the end of March 20201 . While 1.0 percent may not seem material, it can have a significant impact on a business valuation. As illustrated in the table below, increasing a 16.0 percent rate of return by 1.0 percent results in a notable decrease in a valuation multiple, as follows:

Investor rate of return expectation example

| Scenario 1 | Scenario 2 | |

|---|---|---|

| Required rate of return | 16% | 17% |

| Long-term growth rate | -2% | -2% |

| Rate of return net of growth | 14% | 15% |

| Multiple (calculated as 1 divided by rate of return net of growth) | 7.1 | 6.7 |

In our example, the multiple decreases from 7.1 times to 6.7 times. For a business with annual cash flow of $1.0 million, a lower valuation multiple would reduce enterprise value by $400,000, as demonstrated below:

| Scenario 1 | Scenario 2 | |

|---|---|---|

| Example with annual net cash flow of $1 million | 7.1 | 6.7 |

| Multiple as determined above | $7,100,000 | $6,700,000 |

| Difference | $(400,000) | $(400,000) |

The impact on the business value will compound if both the multiple and cash flows decline; find out more in our previous article, Business Valuations during COVID-19 about cash flow impacts and normalization adjustments.

ACTIONS TO TAKE NOW

In the short term, a business needs to determine steps necessary to continue through the lockdown period and emerge into the post-COVID-19 new normal. Even though business values may be affected by the decline in business activity and the uncertainty in financial markets, companies need to be proactive to adapt to a new reality and even take advantage of opportunities in the marketplace. Here is a list of things you should consider doing today:

- Review current cash balance and banking facilities.

- Prepare cash flow projections on a monthly basis over the next 12 months to ensure sufficient cash resources.

- Determine eligibility for various government incentives and loans and prepare applications.

- Prepare financial projections and business plans for the next three years and perform scenario analysis to consider the possible impact of different external factors so you can take strategic action in response to the changing environment.

MNP’s professionals can assist your business with financial planning advice such as financial modelling and valuation expertise to help you navigate the crisis to better times ahead.

Contact

For more information, contact:

Catherine Tremblay, CPA, CA, CBV, ASA, CFF

Partner, Valuation and Litigation Support

514.228.7772

[email protected]