If you are a small- to mid-sized company in Alberta investing in research and development, you could qualify for the new provincial Innovation Employment Grant – regardless of your industry.

Opened in January 2021, the incentive is a tax credit that replaces the provincial Scientific Research and Experimental Development (SR&ED) tax credit program terminated at the end of 2019.

What is it worth?

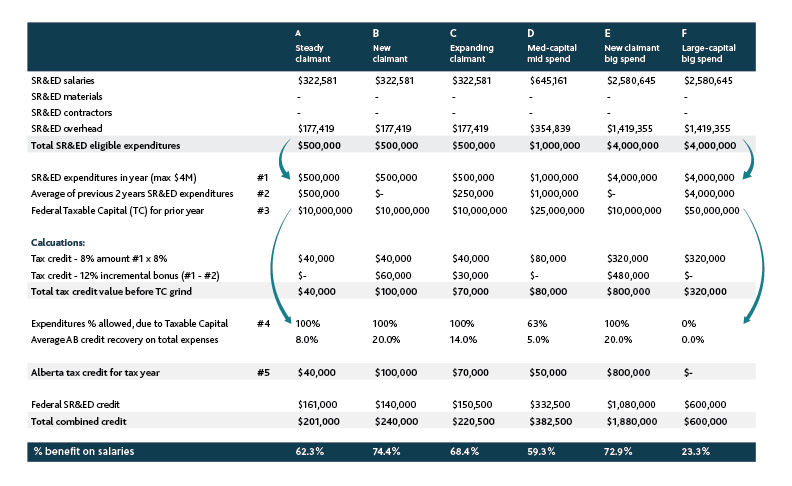

This refundable tax credit offers an eight-percent recovery on eligible expenditures, (up to a maximum of $4 million in eligible expenditures per year) related to SR&ED activities carried out in Alberta.

As well, corporations can claim an additional 12-percent credit in excess of the base amount, which is determined by the average eligible expenditures for the two preceding taxation years. In other words, corporations that increase their year-over-year Alberta SR&ED spend will be rewarded with a bigger tax credit.

As a Canadian-controlled private corporation qualifying for the 35-percent federal rate, the enhanced Alberta rate adds up to a 74-percent recovery on T4 wages. The base eight-percent credit results in a 62-percent recovery on T4 wages.

A corporation that qualifies for the full 20-percent credit (8 percent + 12 percent) on the entire $4 million of eligible expenditures can recover a maximum of $800,000. However, this can only be achieved with a base amount of zero.

Criteria

The tax credit covers eligible Alberta expenditures incurred after December 31, 2020.

Who qualifies

Corporations that have a permanent establishment in Alberta at any time during the taxation year.

Who doesn’t qualify

Corporations with taxable capital (for federal tax purposes) over $50 million, partnerships, trusts, or individuals are not eligible to claim the IEG. Due to the taxable capital limit, the program is focused on funding mostly small- to medium-sized private corporations.

Deadlines

The Innovation Employment Grant tax form is prepared on a project-by-project basis at the end of the taxation year and filed with the corporation’s tax return.

Scenarios

Possible Alberta tax credit recoveries based on research and development spend and taxable capital levels can be seen in the following table: