Contents

- Introduction

- ESG Factors: Drivers of business value

- Sustainability is a strategic priority for boards of directors

- Supporting ESG maturity and carrying out the duty of care

- Sustainability integral to corporate success

Top

Introduction

While environmental, social and corporate governance (ESG) issues are not yet a top priority for many boards of directors, they soon will be.

In the wake of a global pandemic and its significant impacts, the business environment is changing rapidly as it sets a new course for recovery. The effect of the crisis on our interdependent world is now clearly visible.

As society’s focus changed, customer purchasing habits transformed, and stakeholder voices wielded greater influence through social media, the year 2020 became a major ESG turning point.

Governments, investors, lenders, regulators, employees and consumers are now calling on companies to act more transparently, equitably and sustainably. There is growing pressure for businesses, when creating economic value, to consider the interests not only of their shareholders, but those of all stakeholders.

Download the Driving Forces of ESG Infographic

To view an accessible version of this infographic, please download the accessible pdf.

From shareholders to stakeholders – the focus of business models is evolving

“In today’s complex and uncertain world, focusing on near-term shareholder value alone is no longer enough to ensure long-term business success.

Sustained value creation requires companies to manage business performance to ensure that sustainability matters that affect business value are addressed.

At present, substantial value is being destroyed by governance systems that fail to address wider sustainability matters affecting the company.”

Source: Modernizing Governance, World Business Council for Sustainable Development, January 2020

Future value creation will be based on today’s sustainability decisions. The two elements – value and sustainability – are inextricably linked.

At the same time, with new tools and metrics available, it is now possible to assess the performance of companies in terms of their impact on society using ESG factors.

There is increasing community, government, and consumer attention on the broad impact of corporations. It is now possible to assess the performance of companies in terms of their impact on society using ESG factors through globally developed and publicly available tools and metrics. Lenders, investors and corporate leaders are realizing that strong ESG performance contributes to long-term business success.

Top

ESG Factors: Drivers of business value

Environmental

- Energy efficiency

- Carbon footprint

- Water consumption

- Waste management

- Packaging

- Biodiversity management

Social

- Employee attraction and retention

- Diversity and inclusion

- Pay equity

- Customer data privacy

- Social acceptability of projects / business

- Organizational culture

Governance

- Climate change

- Cyber security

- Corruption and bribery

- Responsible taxes

- Compensation

- Reliable financial disclosure

To embed sustainability into the fabric of unique cultures and operations, every corporation will need to address different ESG factors using different strategies and unique performance measures. Ultimately, this focus has the potential to change the way business is conducted.

Directors expected to provide effective ESG oversight

The bar for ESG factors has never been higher. According to the Canadian edition of the Edelman Trust Barometer Special Report: Institutional Investors, among 600 institutional investors surveyed around the globe, 95 percent expect their firms to intensify their focus on ESG.

The report found that as companies recover from the impacts of the pandemic, more institutional investors are expecting businesses to focus beyond short-term value creation and play a greater role in society.

Even more imperative for company directors – 98 percent of the Canadian investors surveyed are expecting boards of directors to oversee at least one ESG topic.

Source: 2020 Edelman Trust Barometer – Special Report – Institutional Investors – Canada results, November 17, 2020

As ESG issues ascend to strategic priorities in order to drive sustainable corporate value, boards must adapt to this shifting business reality. They must understand the drivers of change impacting the business and how to respond.

This white paper discusses these evolving board responsibilities and steps directors can take to effectively oversee and report on sustainability and ESG – issues that are increasingly crucial to the success of businesses.

Top

Sustainability is a strategic priority for boards of directors

As new research consistently demonstrates, ESG factors have a material financial impact on an organization’s short- and long-term value.

The results of a recent study1 shared in the Harvard Business Review revealed that when companies target the right issues, they benefit financially. Researchers analyzed the performance of more than 2,000 US companies over 21 years and found those that improved on material ESG issues significantly outperformed competitors.

This research also revealed companies that outperformed on immaterial ESG issues slightly underperformed competitors. This suggests that investors can distinguish between greenwashing and real value creation.

Concurrently, ESG factors are an increasingly significant factor in the ability of companies to access capital.

- The 2020 RBC Global Asset Management Responsible Investment Survey2 of 800 institutional investors around the world found that 89 percent of those in Canada integrate ESG principles into their investment approach and decision-making.

- Fitch Ratings, a credit rating and research firm for global capital markets, which conducted a survey3 of 182 banks around the world at the end of 2019, found they screened about half of their lending for ESG risks.

- Some 190 banks have adopted the Principles of Responsible Banking, which were established by the United Nations in 2019. These principles focus on driving change by the banking community through a positive contribution to people and the planet. These banks represent more than 1.6 billion customers worldwide and around 40 percent of global banking assets. And the number of banks signing on to these principles continues to grow.

Corporate stakeholders – investors, lenders, customers, employees, regulators, and others — are now viewing business performance through an ESG lens. This is leading to a shift in the way companies must prepare to measure and disclose their performance.

Top

Supporting ESG maturity and carrying out the duty of care

Integrating ESG factors into strategic and operational analysis and decision-making needs to be paramount for boards and management teams alike.

Companies recognize the value of innovative boards

“With the pace of change in expectations of corporations accelerating and stakeholder impacts becoming increasingly salient to company operations, if there ever were a time to have a high-performing board, it is now.

Effective boards will need to be expert in recognizing ways that their companies’ interests could have adverse impacts on stakeholders and seek to resolve these tensions in creative and generative ways.

Importantly…stakeholder pressures are ….also opportunities for innovation and transformation.”

Source: 360º Governance: Where are the Directors in a World in Crisis? Peter Day and Sarah Kaplan, February 2021

As ESG governance becomes a new board standard, to effectively respond to the ESG drivers of change impacting the business, directors need to understand the following.

- The impact of ESG matters on the corporate purpose

- The company’s ESG footprint

- The opportunities, risks and potential impact of existing and emerging ESG issues on the organization

- How ESG issues and stakeholders are prioritized

- How stakeholder consultation is conducted, and feedback is acted upon

- How ESG considerations are integrated into business decision making

- How ESG is embedded into corporate culture

- How sustainability performance and progress is evaluated

- Changing demands and requirements regarding ESG disclosure and reporting

- How business strategies are aligned with the expectations of regulators and stakeholders

- How the company’s approach to ESG is being monitored, measured and reported

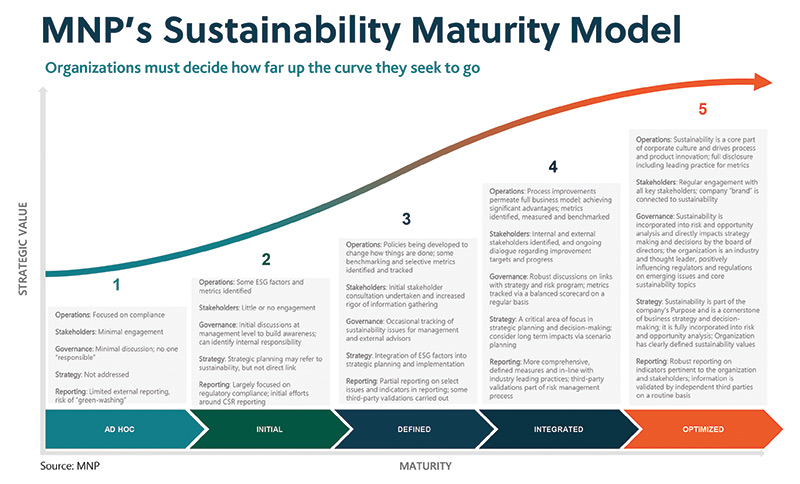

A sustainability maturity model is a helpful reference to assess the progress of corporate ESG efforts. MNP’s model categorizes ESG issues into the critical components – operations, stakeholders, governance, strategy and reporting – that drive a successful sustainability program.

Typically, corporate leaders choose a level of ESG maturity that links to strategic objectives or that is prescribed by industry standard or relevant legislation.

MNP's Sustainability Maturity Model Infographic

To view an accessible version of this infographic, please download the accessible pdf.

Directors can reference their company’s position against this model to:

- determine the current maturity of their organization’s ESG strategies;

- assess how the company’s efforts compare with those of other organizations; and

- identify ways to improve the organization’s approach to reporting on ESG matters.

A key part of director’s fiduciary responsibility is the duty of care — the duty to adequately inform yourself about these issues. Canada, unlike other jurisdictions such as the U.S., has the advantage of a 2008 Supreme Court of Canada decision which held that boards of directors have a duty to act with a view to the best long-term interests of the corporation, and not exclusively in the interests of the shareholders.

For the four key phases on the path to building ESG maturity, the following are some of the issues directors should be considering in effectively carrying out their duty of care.

1. Map your corporate ESG footprint

Board members should have a clear picture of their organization’s complete corporate footprint and the ESG factors therein. This includes all of the activities involved in producing, selling and using its products and services and the impact on stakeholders.

- What is the impact of the business across its entire value chain: operations, supply chains and distribution channels?

- Does the company have a clear, current map of these activities and impacts?

2. Prioritize ESG issues and stakeholders

Directors should understand which ESG factors are financially material – those that have a significant impact on the business. These will help to define the corporate purpose, a purpose that considers stakeholder needs and that drives long-term value.

- What ESG risks and opportunities could impact the organization’s ability to generate long-term value?

- Has management examined pertinent ESG standards and frameworks to determine whether the company is addressing and reporting on the industry’s most significant risks?

How do your company’s ESG activities align with the UN Sustainable Development Goals?

If your organization is just beginning to embark on sustainability initiatives, a helpful starting point is to reference the United Nations’ 17 Sustainable Development Goals.

The underlying principles of current ESG standards and frameworks relate to these global goals. UN member states adopted these goals in 2015 to end poverty, protect the planet and ensure all people enjoy peace and prosperity by 2030.

These 17 goals are integrated, recognizing that action in one area affects outcomes in others, and that development must equitably balance social, economic and environmental sustainability.

- Has the organization consulted with stakeholder groups to consider their perspectives on relevant ESG issues related to the company?

- How does management prioritize ESG risks and opportunities? Are the most important ones integrated into business strategies?

- What is the organization’s current governance structure related to ESG management and performance disclosure?

- Do you have a clear and current corporate purpose statement to guide strategic decision making? Does it explain how the organization will create value for all stakeholders?

3. Assess sustainability performance and progress

ESG issues should be embedded within the context of a company’s strategic objectives and enterprise risk management framework. Questions such as the following may be helpful to provide oversight.

- Are ESG factors appropriately integrated into enterprise risk management?

- Has materiality been established with material ESG risks identified?

- What are the policies and processes used to monitor and manage relevant ESG risks and opportunities?

- What performance targets have been established to link ESG issues to business strategy and the bottom line?

- How is sustainability progressing in relation to goals and milestones?

4. Reporting

Companies are increasingly being called upon by stakeholders to provide transparent and comparable information on corporate ESG risks and performance. This expectation is advancing toward holistic reporting – financial reports enhanced by relevant, timely reporting on sustainability issues that hinder or drive value.

The CEOs of eight leading Canadian pension plans issued a joint statement at the end of 2020 calling on companies and investors to provide complete and consistent ESG information to facilitate assessment of ESG risk exposures and investment decision making.4

Integrated reporting – consolidated financial and non-financial sustainability disclosures – is coming.

IFRS (International Financial Reporting Standards)

Website: Foundation to develop universal framework for corporate sustainability reporting

While disclosure standards and methods continue to evolve, and there is currently no global ESG framework applicable to every country or company, work is underway.

In the fall of 2020, the International Financial Reporting Standards Foundation (IFRS Foundation), which oversees the International Accounting Standards Board (IASB), proposed the creation of a Sustainability Standards Board (SSB) to establish a framework for sustainability reporting. The foundation published a consultation paper to assess demand for global sustainability standards and what role it might play.

After reviewing responses to the consultation paper, the foundation announced in February 2021 it will take a leadership role in creating a universal framework for corporate reporting on sustainability issues. Trustees met in March: next steps and key dates are as follows.

- A definitive proposal, including a road map and timeline, is expected by the end of September 2021.

- The establishment of a SSB is expected to be announced in November 2021 during COP26, the meeting of the United Nations Climate Change Conference.

While it may be some time before there is a universally adopted standard for how companies measure and report on their sustainability performance, corporate boards and management teams will need to decide whether to follow what seems to be an emerging consensus around new SSB standards.

And they will need to consider how they wish to start or rethink ESG disclosure and risk oversight, including:

- What is the company’s approach to dealing with stakeholder expectations and requests for ESG-related disclosure and reporting? Does our reporting include stakeholder impact?

- What disclosures will be required as part of integrated reporting?

- What disclosure regime should the company follow?

- Is the organization collecting data on material ESG issues to support verifiable disclosure?

- What action is the company taking to prepare for changing demands regarding ESG disclosure?

- Will the approach to disclosures meet third-party assurance requirements?

Top

Sustainability integral to corporate success

“The governance standards of the 20th century are simply not adequate to address the challenges of the 21st century.

The real issue comes down to providing insight into guidelines that emphasize the need for corporate purpose, deep understanding of all stakeholders, rigorous board refreshment, realigned executive compensation, and active policies on the environment, diversity, equity and inclusion.

A truly competent board of today must chart a path for tomorrow through identifying and embracing a comprehensive approach.”

Source: 360º Governance: Where are the Directors in a World in Crisis? Peter Day and Sarah Kaplan, February 2021

As organizations move forward in strengthening sustainability, the guidance and commitment of the board of directors will be critical to success. ESG momentum is a powerful force.

Boards that leverage this force by embracing sustainability goals and integrating ESG measures into governance practices will strengthen corporate performance, gain competitive advantage – and make a world of difference.

Learn more about ESG

1. Social-Impact Efforts That Create Real Value, Harvard Business Review, Sep/Oct 2020, George Serafeim

2. 2020 RBC Global Asset Management Responsible Investment Survey, October 2020

3. ESG Bites into Banks' Lending to Corporates, January 7, 2020, Fitch Ratings

4. Demand for Better ESG Oversight and Disclosure in Canada, Stephen Erlichman, Harvard Law School Forum on Corporate Governance, December 16, 2020