As 2020 comes to a close, companies across the Canadian cannabis value chain are struggling to generate positive returns and cash flow from operations. So why pay attention to soft business drivers such as environmental, social and corporate governance (ESG)?

Table of Contents

- What is ESG?

- ESG relevancy in the cannabis sector

- The link across strategy, culture and ESG

- Conclusion

Top

What is ESG?

Businesses and institutions face – and report on – financial risk, as we all know. But there is an array of financially material risks which are equally, if not more, critical to success or failure. These include business ethics, human rights abuses, operational impact on and of the environment, employee turnover, discrimination, and cyber security. These risks fall under the rubric of environmental, social and governance (ESG) management and reporting.

ESG business drivers

Environmental

- Energy efficiency

- Carbon footprint

- Water consumption

- Waste management

- Packaging

- Biodiversity management

Social

- Employee attraction and retention

- Diversity and inclusion

- Pay equity

- Customer data privacy

- Social acceptability of projects / business

- Organizational culture

Governance

- Climate change

- Cyber security

- Corruption and bribery

- Responsible taxes

- Compensation

- Reliable financial disclosure

In 1994, the term Triple Bottom Line was coined to reflect a growing view that a single-minded focus on corporate profit was inadequate; some investors, academics and public organizations sought to measure the degree to which a corporation was socially and environmentally responsible through its operations and activities. At the time, so-called impact investing accounted for a miniscule portion of the global financial world.

Then 2005 birthed ESG through a landmark study entitled Who Cares Wins published by the United Nations Global Compact. Four years later, Canada launched its first Corporate Social Responsibility Strategy to address the Canadian extractive sector abroad. The ESG ball was rolling: 2015 brought the formal establishment of the United Nations’ 17 sustainable development goals which encourage companies to “adopt practices and sustainability reporting.”

The idea of sustainable and responsible investing has been moving into the mainstream with continued velocity. Investors, pension plans, financial institutions, universities and corporate boards and CEOs are paying more attention to incorporating ESG principals, or at least appearing to.

There was (and still is) a lot of greenwashing and greenwishing going on. But the realization has gradually taken hold across global organizations, business leaders and Canadian and international investors that there are sound reasons to pay attention to these ESG risks: they are financially material, and they matter a lot.

The World Economic Forum has launched a major initiative to “improve the ways that companies measure and demonstrate their contributions toward creating more prosperous, fulfilled societies and a more sustainable relationship with our planet….and recognizes that companies that do so will be more viable – and valuable – in the long term.” Investment brokerage BlackRock CEO Larry Fink warned earlier this year that CEOs who don’t take steps to address climate and environmental risks “will encounter growing skepticism from the markets, and in turn, a higher cost of capital.”

Most recently, the Royal Bank reported that the percentage of institutional investors in the U.K. and Canada who ‘significantly” or ‘somewhat’ adopt ESG factors as part of their investment approach and decision-making process reached 97 percent and 80 percent, respectively. Why? Because a “positive performance impact (mitigating risk and enhancing returns)” is now the top-cited reason for incorporating ESG considerations in investment decisions.

TopESG relevancy in the cannabis sector

As business leaders, the idea of paying attention to non-financial matters may not seem like a high priority, particularly in the context of the challenges being experienced by the cannabis sector, only exacerbated by the COVID-19 pandemic.

Interestingly, COVID-19 has seemingly magnified the importance of ESG. Several trends appear to be at work

1. There is evidence that values are shifting across the C-suite, management teams and employees.

A global study done by U.K.-based research institution, The Barrett Values Centre, has pointed to a shift in espoused values, with much greater emphasis on seriously addressing issues around the environment, justice, equity, diversity and inclusion (JEDI), and how decisions are made.

It should not be forgotten companies seen to share and exhibit their employees’ and customers’ values will benefit from a stronger brand, stand out from others and be far more likely to win the war for talent.

The cultural impact of COVID-19

A shift in personal values

What is important to people now vs pre-COVID?

- Making a difference

- Adaptability

- Well-being

- Caring

The new employee experience

Despite the fear and uncertainty surrounding the pandemic, there have been a number of positive changes in the way employees experience.

| From | To |

|

Performance Control Hierarchy |

People Focus Adaptability Working Together |

Source: Barrett Values Centre

2. Perhaps because of the COVID-19 crisis we are all living through, CEOs and boards are realizing the balance between the community good and economic viability needs to be reconsidered.

The fact the pandemic has co-existed with climate disasters in the U.S., Europe and elsewhere, racial divisiveness in North America and political unrest in Eastern Europe only exacerbates a move to re-examine how we think about the role of business in society.

3. Governance is another factor. Boards are simply becoming more sophisticated. And they are thinking far more broadly about risk.

This may not be true across all sectors or across all companies, but board members seem to be moving away from seeing their roles as “rear window” managers and more as stewards of strategy and organizational culture. Topics being considered by boards require expertise in issues that go well beyond compliance, finance and legal matters. Boards are pushing considering issues of serious materiality – particularly around environmental and social matters – to the forefront of discussions.

4. Funding entities increasingly want to see ESG measures in place with their clients, and with access to capital likely becoming more difficult in the next few years, this could be crucial to survival.

For example, The Export Development Corporation is integrating ESG considerations into its funding decisions. The Principles for Responsible Banking (see below) were implemented in 2019 and since then more than a third of the global banking community have become signatories. These principles are designed to ensure signatories, strategies and lending practices “align with the vision that society has set out for its future.” These are just two of the signals of changes in finance accessibility and increasingly related restrictions.

5. And finally, there is organizational culture.

Where all these trends are leading is to a shift in how business leaders are thinking about their mission, their strategy, their people and how they “get things done” – in other words, their culture. If we think about ESG factors as critical drivers of strategic success or failure, then linking related values and ethos with day-to-day operations within and across the company just makes sense, as illustrated below.

Principles of responsible banking

Source: UNEP Finance Initiative, The Principles for Responsible Banking

TopThe link across strategy, culture and ESG

Market focus on ESG growing

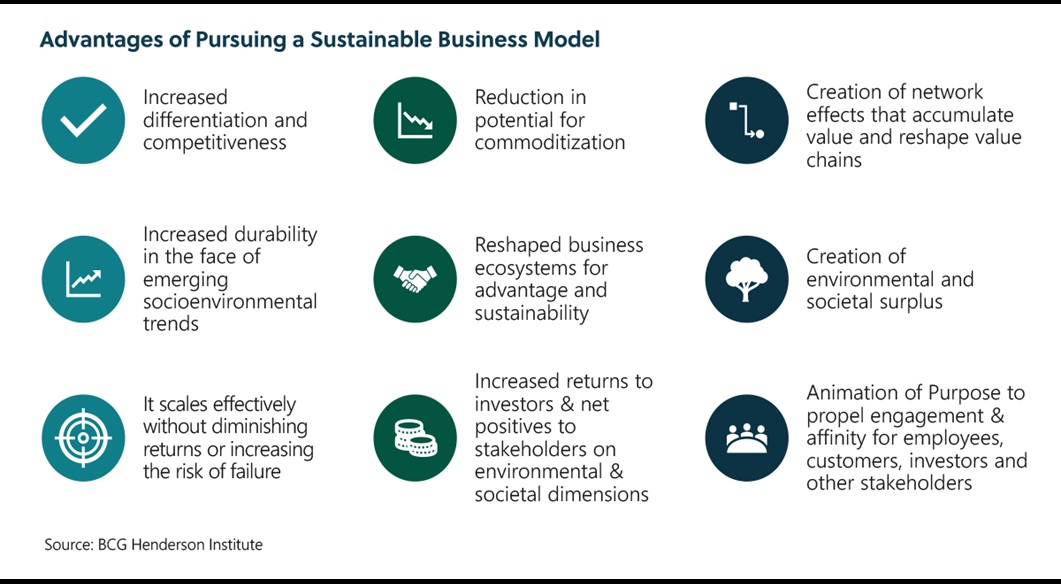

We have seen many examples of ESG focus on the part of companies in the cannabis sector, e.g. efforts to reduce energy in the growing cycle; focus on equal opportunity hiring and promotions; commitment to sustainable farming practices; and ensuring health and harassment free workplaces. As the impetus for ESG is growing, significant benefits accrue for businesses that identify, manage, track, and report on financially material, strategically relevant ESG factors.

Advantages of pursuing a sustainable business model

Source: BCG Henderson Institute

It is our view the sector can reap meaningful advantages by taking a more systematic approach to addressing ESG. This can begin with reviewing the company’s business strategy and compliance requirements and identifying financially material opportunities and risks.

- For example, on the upstream side of the business, it is increasingly important to drive down costs in the face of product commoditization, so sustainable agricultural practices could be critical to the financial health of the business. Minimizing overhead is also a business imperative but keeping a close eye on diversity and inclusion issues and data security could make a major difference in a company’s risks.

- For downstream players, paying attention to the potential risks associated with slave labor for product coming from overseas may be important. Waste management associated with packaging could also be a source of competitive advantage – or the opposite.

Having identified important areas of ESG focus, a company might want to hold conversations with their board, management team and various stakeholders to determine current and desired levels of ESG engagement and importance. Stakeholders could range from customers and suppliers through to affected communities, investors, regulators and even competitors. From this work, it is possible to create a business case that articulates the benefits and costs associated with proactive pursuit of an ESG strategy.

Attain the right level for your enterprise

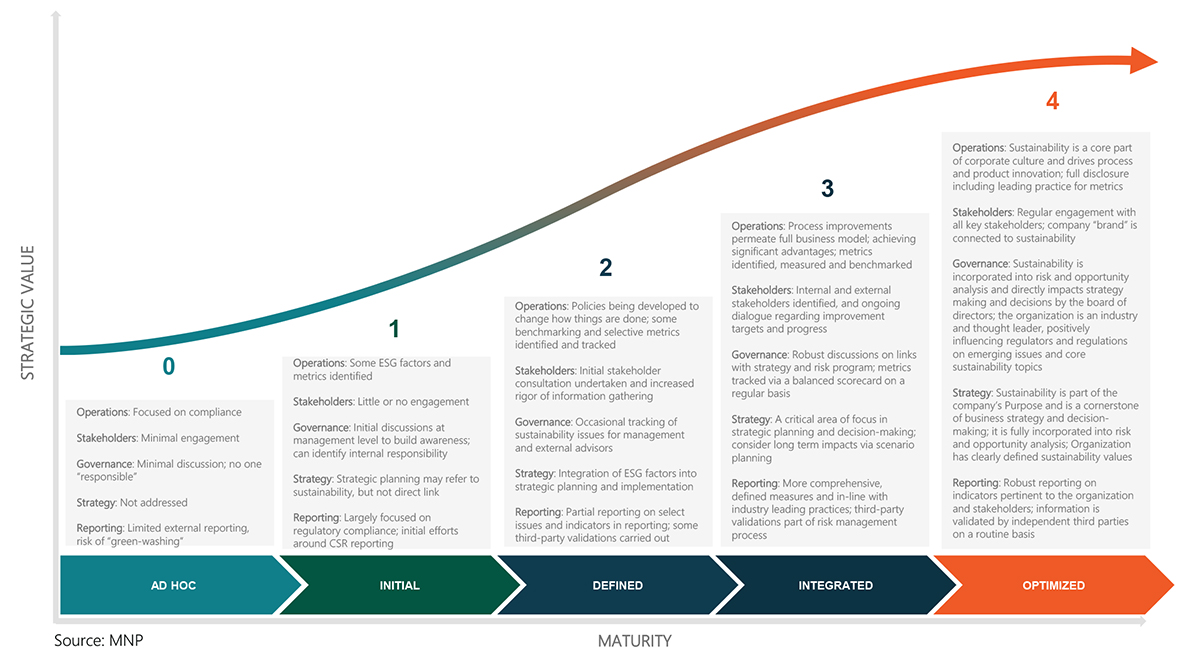

There is no one-size-fits-all approach to ESG, but making a start is critical. The following Maturity Model suggests there is great power in moving from Stage 0 even to Stage 2. Stage 4 may not be achievable or even necessary for many organizations.

MNP’s Sustainability Maturity Model

Reporting framework critical

Reporting is the ultimate, transparent disclosure of financially material issues which are meaningful to internal and external stakeholders. It provides the information necessary for stakeholder decision-making to include those issues that extend beyond the bottom line, and yet directly impact financial outcomes. Making use of a globally accepted ESG framework for reporting is a critical part of an increasingly values-based economy, bringing consistency and comparability to industry participants.

Reporting needs to include meaningful corporate information – providing an overview of your profile, strategy, ethics and governance, but also extends through to those policies, commitments, targets, responsibilities and other specific actions that are specifically put in place by management and the board of directors. Reporting should also include enough information on those financially material topics that impact your company – things such as anti-corruption, energy utilization, water consumption, as well as diversity and inclusion are just a handful of examples. Sufficient detail is needed, both quantitatively and qualitatively, to compare corporate results year-over-year as well as to benchmark with industry competitors.

Lastly, use reporting as a differentiator. MNP recently conducted a high-level review of 16 cannabis producers and ancillaries to assess the ESG posture within reporting. We found that while 100 percent of companies reported on social disclosures, only 38 percent reported on diversity standards.

Considering socioenvironmental trends, if you define and report on diversity standards, you are already ahead of 62 percent of your competitors – something which needs to be considered when differentiating from your competition.

TopConclusion

We are in a world of increasing complexity; it is important to keep your starting point and suggested next steps simple. Consider these takeaways:

- All ESG principles and frameworks reference back to the globally accepted, universally adopted goals established by the United Nations through the Sustainable Development Goals. Evaluate these 17 goals and select those which you directly impact.

- Conduct a quick baseline assessment of what you are doing today – do you know your stakeholders or are you already reporting on some environmental, social and corporate governance issues? You may actually be further ahead than what you originally thought.

- Identify a handful of most pertinent, financially material ESG issues your company faces.

- Begin the process of measuring and monitoring the identified ESG issues while ensuring the completeness and accuracy of the underlying data.

- Set a target on where you want to go for each ESG issues – evolve from where you are at today to who you want to be tomorrow. As with your business, you want to continually improve your ESG disclosures.

- Of the globally accepted ESG frameworks available (e.g. Global Reporting Initiative, Taskforce on Climate-Related Financial Disclosures, Sustainability Accounting Standards Board, and the World Economic Forum) select at least one to report against.

- Use this reported information to strategically differentiate and drive financial performance.

- Recognize when to maximize your expertise and when to call in an experienced third-party advisor to work with you on developing an effective ESG program for your business.

Mary Larson, Partner Consulting Services | 514.228.7905 | [email protected]

Kevin Joy, Partner Consulting Services | 514.228.7898 | [email protected]

Edward Olson, Regional Leader Enterprise Risk Services & ESG | 250.718.8687 | [email protected]