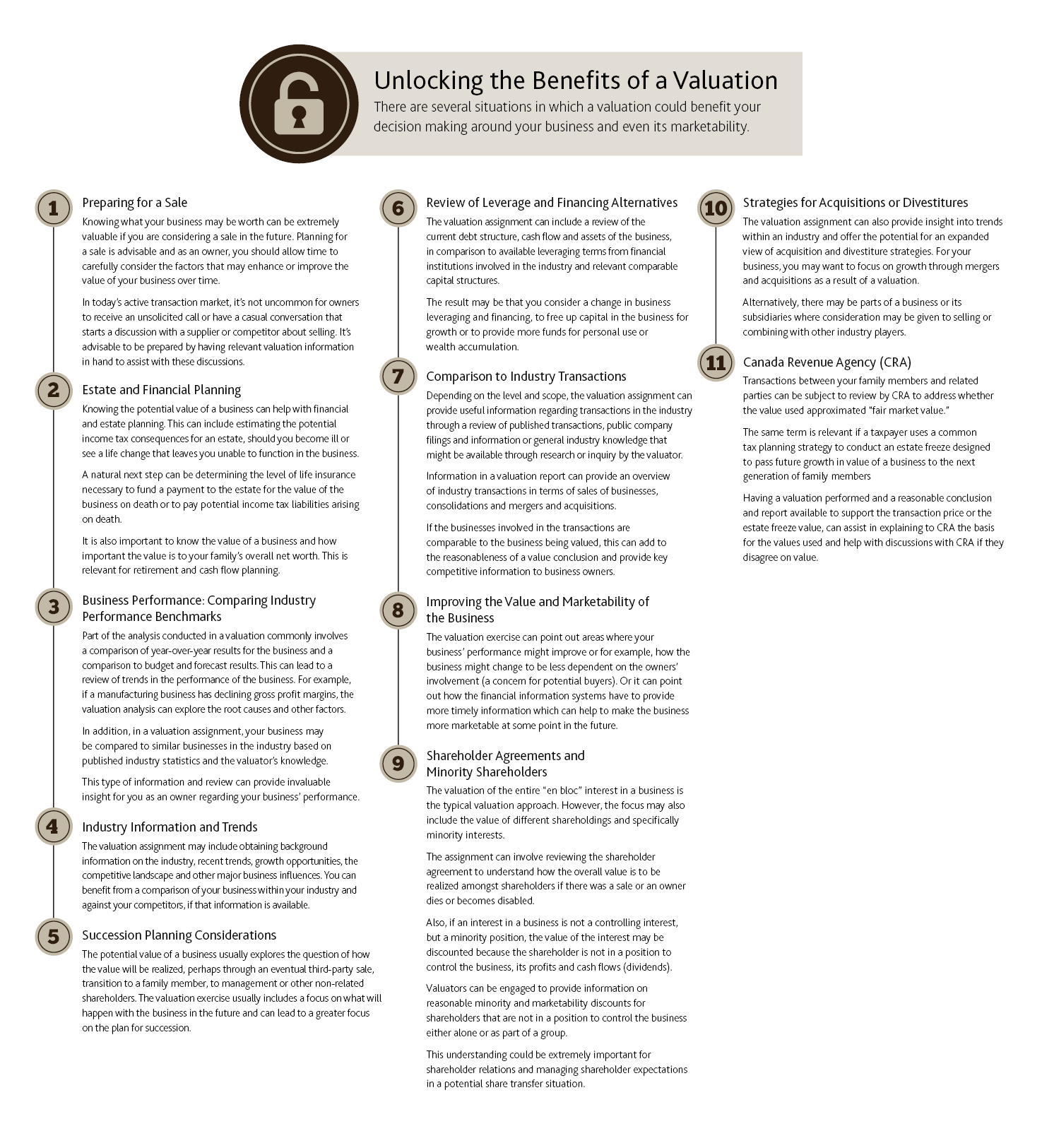

As a business owner, you know that the decisions you make about your business' future impact your shareholders, employees as well as you and your family. In order to maximize its marketability, prepare for succession or even a sale, you need to know the real worth of your business' assets and shares. A valuation of your business can determine how competitive it is today as well as future opportunities. There are many benefits to obtaining a valuation, some obvious and others less so. In this article, we'll look at the different types of reports you can obtain as well as the most common — and surprising — ways a valuation can benefit your business.

Understanding the Different Types of Valuation Reports

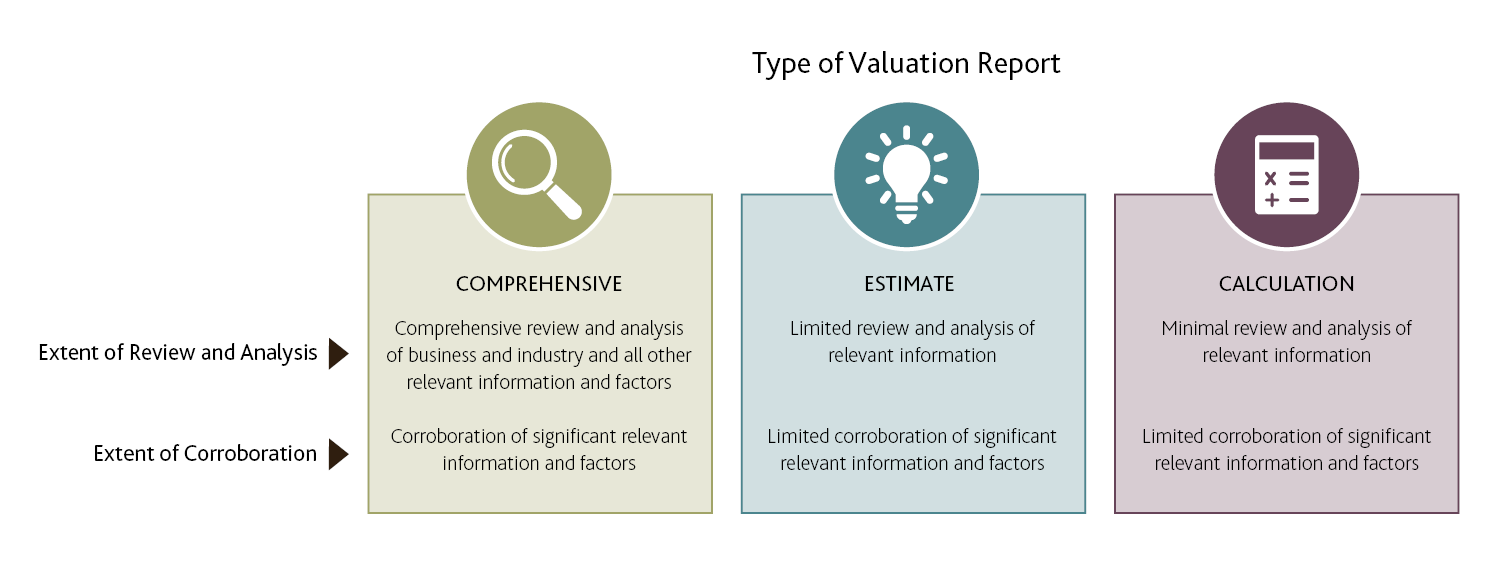

Generally, there are three types of business valuation reports and related assignments:

The type of report is dependent on the purpose of the valuation. For example, if a valuation matter involves litigation, a comprehensive report may be appropriate. Otherwise, an estimate or calculation report may be enough.

The scope of an assignment can be expanded to focus on desired areas of the valuation exercise, such as searching for comparable industry transactions or comparable arms’ length salaries for family members.

In the end, a valuation is designed to address a specific purpose and provide an overview of the value of the business and the related valuation issues. Retaining the services of an experienced and qualified Chartered Business Valuator can provide meaningful insights regarding your business and lead to areas to focus upon to improve the business and its value.