MNP’s property tax services

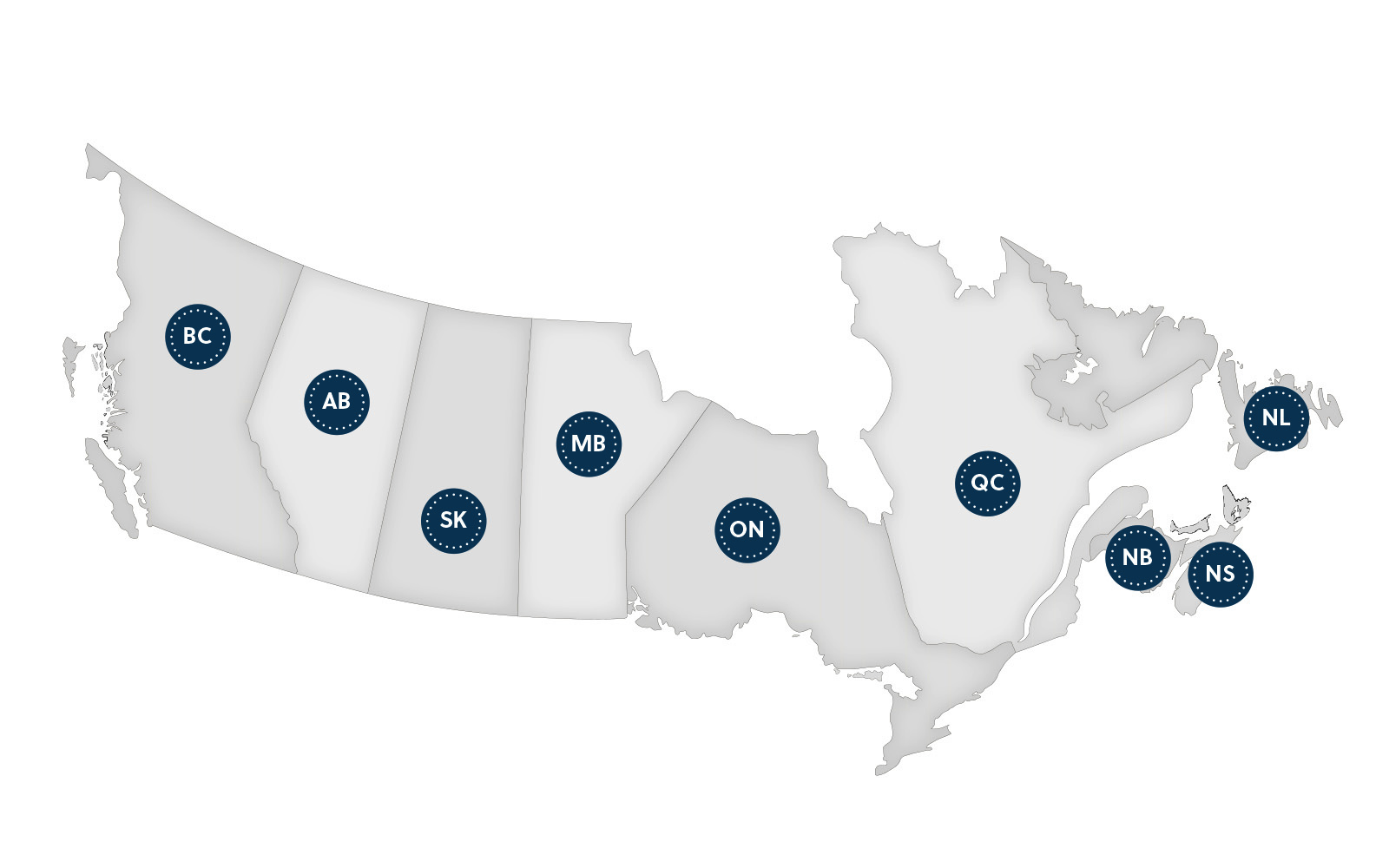

MNP’s Property Tax Services (PTS) integrates industry-leading property tax expertise with the thorough management of assessment appeal and processes across major Canadian municipalities.

Our approach

Property taxes represent a significant portion of your operating costs. Minimizing this tax liability improves the competitiveness and liquidity of your assets, specifically those situated in challenging real estate markets.

MNP offers you effective tax strategies for each property you own. MNP values transparency in its dealings with clients which is why our services are by nature and design meant to keep you informed at every level of the annual assessment process.

- Examining income statements, analyzing rent rolls, reviewing sales data, and assessing levels of similar comparable properties;

- Assessing whether the municipality has established the fair market value estimate for your property;

- Reviewing tax property assessment details for errors or omissions to determine if you are paying your fair share of taxes; and

- Meeting with the assessor to review the working papers in the municipal file

- Assessment tribunal representation

Assessment Area / Assessment Notice Mailing – Dates

| Province | Date | Province | Date |

|---|---|---|---|

| British Columbia | January, 2021 | Quebec | Fall 2021 (Quebec City, Laval) Fall 2022 (Island of Montreal) |

| Alberta | January, 2021 (Calgary and Edmonton) |

New Brunswick | January, 2021 |

| Saskatchewan | January, 2021 |

Nova Scotia | January, 2021 |

| Manitoba | Spring, 2021 (Winnipeg) Fall, 2021 (Rural) | Newfoundland | June, 2021 |

| Ontario | Late Summer to Early Fall 2021 |

Prince Edward Island | May, 2021 |

Canada’s diverse markets make it challenging for assessors to accurately estimate the market value of your property.

A comprehensive review of the value levied on your property for tax purposes is the first step in determining if you are assessed for your fair share of taxes in relation to competing properties.

Assessment concerns – MNP resolutions

| Potential Issue | MNP Process |

|---|---|

| Equitable Assessment | We review comparable properties, case law and previous tribunal decisions |

| Market value | We will perform in-house assessment valuations, research transactions and market trends |

| Property description | Review rent rolls, tenancy mix, architectural schematics, capital expenses and site inspection |

| Cost of development | Review critical legislative dates to determine the optimal period to begin construction and mitigate taxation through the development cycle |

| Tax class | We ensure appropriate assessment class (residential/non- residential, farmland, exemptions, etc.) |

| Municipal information requests | Work with client to comply with assessor information requests |

Property tax advice you can rely on

Minimize Time Spent Reviewing Property Taxes and Maximize Opportunities

Our experience, adherence to best practices and a proven due diligence process decreases the likelihood of missed opportunities, unproductive appeals and increased risk. We guarantee you get the whole story — the first time around.

Secure the Best Possible Assessment Outcome

Our team will identify tax reduction opportunities and advise on any potential exposure to future tax increases.

Enhance Potential Return on Investment from Future Tenants

With lower operating costs, you will have the liquidity to make your properties more competitively advantageous to potential tenants or investors. We will provide you with accurate and timely information to make strategic business decisions.

Download

Download the Property Tax Services, Are you paying more than your fair share of taxes? brochure.